Our latest #GOPCThread is up on Twitter today, with a review of the City of Cleveland’s recent analysis of its residential tax abatement program. Lead by the Reinvestment fund, with help from GOPC, PFM, and Neighbor Up CLE

Not on Twitter, the thread is available online , as well as below.

Greater Ohio Policy Center Read on Twitter

Earlier this month, @CityofCleveland released an analysis of its residential Tax Abatement program. @ReinvestFund led the research w help from GOPC, #PFM, @NeighborUpCle #GOPCThread

Variations of @CityofCleveland abatement program have been around since the 1990s; we looked at data from 2004-2018 #GOPCThread

. @ReinvestFund analyzed 1Ks of real estate transactions, #PFM scanned 12 other cities’ programs; we spoke to 73 different “grasstops” stakeholders, @NeighborUpCle interacted w/ 250+ “grassroots” leaders + residents #GOPCThread

The entire process was guided by the Community Development Dept & a robust, highly-engaged, multi-sector advisory team, the Equitable Redevelopment Working Group that included Councilpeople @zonemat @kerrymccormack1, @TBrancatelli, @ClevelandWard5 #GOPCThread

The research team found a few things. #GOPCThread

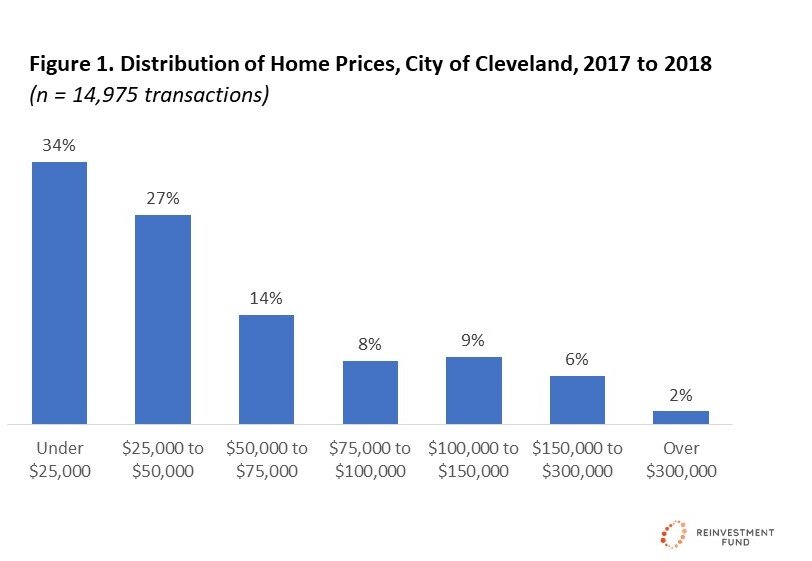

Finding 1) the #CLE housing market remains fragile, but with a few areas of emerging strength. #GOPCThread

Finding 2) Abatements have become increasingly concentrated in fewer places and increasingly used for for large multifamily developments #GOPCThread

Finding 3) There is no *consistent* relationship between tax abatements & residential displacement. Those areas experiencing displacement pressure are in blue; abatements have been granted in large #s in & outside the blue areas #GOPCThread

Finding 4) Tax abatements were associated w/ substantial economic activity in #CLE + #NEOhio #GOPCThread

Finding 5) There is near-universal support for the tax abatement program; however EVERYONE is worried about residential displacement due to rising property taxes in hot markets #GOPCThread

Bottomline on what we found: the abatement is an important tool, but could use some refinement. #GOPCThread

The team made 6 Recommendations for adjusting the tax abatement program in the future. These were developed pre-COVID; we encourage @CleCityCouncil to adjust the program in concert with an upcoming 10-yr Housing & Investment study #GOPCThread

Rec 1: @CityofCleveland should continue to offer a tax abatement for residential properties tied to green construction standards #GOPCThread

Rec 2: Cap the maximum abated value for new-build single family abatements at $300k #GOPCThread

Rec 3: Implement a “but-for” requirement for market rate multi-family projects w abatement values >$5M. A “but-for” test requires a determination that the activity that qualifies for an abatement would not occur without (but-for) the tax abatement incentive. #GOPCThread

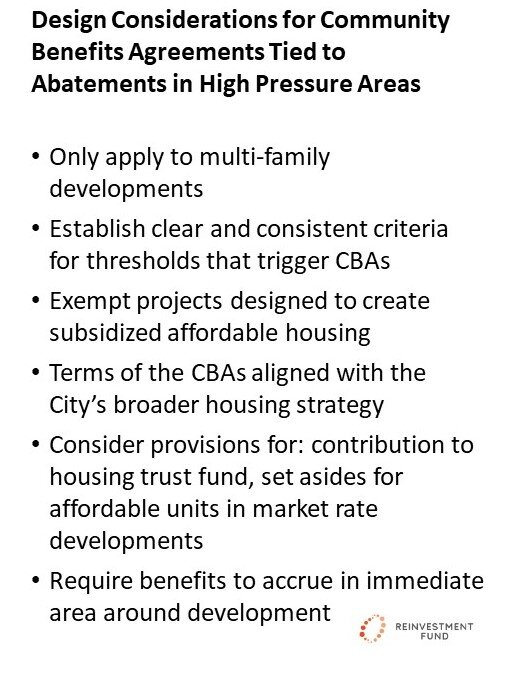

Rec 4: Establish a framework for community benefits agreements for multi-family market rate projects in block groups w/ high displacement pressure #GOPCThread

Rec 5: Develop a specific housing market displacement threshold where the City would trigger adjustment to the term or % of the abatement, by block group. Below is a case study of what could eventually occur in #CLE #GOPCThread

Rec 6: Implement process improvement to enhance transparency w/ other taxing entities + streamline application itself #GOPCThread

With the report released, the hard work is now about to begin for the Community Development Dept, Equitable Redevelopment Working Group, stakeholders, and city residents in crafting revisions to the tax abatement program. #GOPCThread