By Lindsey Gardiner, Manager of Government Affairs

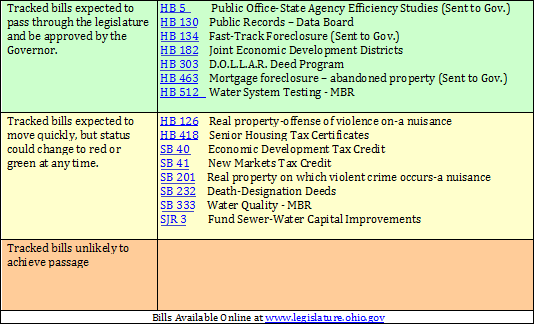

The following grid is designed to provide you with insight into the likelihood of passage of the legislation we are monitoring. Please note that due to the fluid nature of the legislative process, the color coding of bills is subject to change at any time. GOPC will be regularly updating the legislative update the last Thursday of every month and when major developments arise. If you have any concerns about a particular bill, please let us know.

Updates on Key Bills:

HB 130 UPDATE: On April 12th, HB 130 received another hearing in the House Finance Committee. HB 130, which proposes to create the DataOhio Board, specify requirements for posting public records online, require the Auditor of State to adopt rules regarding a uniform accounting system for public offices, and establish an online catalog to establish the Local Government Information Exchange Grant Program, was amended by Representative Mike Duffey to remove an appropriation. There were numerous proponents, who offered testimony on behalf of the bill including The Ohio Newspaper Association, and The Ohio State University’s John Glenn College of Public Affairs. Written proponent testimony was submitted by the office of Auditor Dave Yost, the Ohio Society of CPAs, the Mid-Ohio Regional Planning Commission, the Federal Reserve Bank, the Ohio Municipal League, and various local government officials. On April 20th, GOPC submitted written testimony as an interested party for HB 130 and the bill was subsequently passed by the Committee. The next step for this bill in the legislation process is for the bill to be referred to the Speaker’s office, where he will decide when or if the bill will receive a vote on by the House.

HB 130 UPDATE: On April 12th, HB 130 received another hearing in the House Finance Committee. HB 130, which proposes to create the DataOhio Board, specify requirements for posting public records online, require the Auditor of State to adopt rules regarding a uniform accounting system for public offices, and establish an online catalog to establish the Local Government Information Exchange Grant Program, was amended by Representative Mike Duffey to remove an appropriation. There were numerous proponents, who offered testimony on behalf of the bill including The Ohio Newspaper Association, and The Ohio State University’s John Glenn College of Public Affairs. Written proponent testimony was submitted by the office of Auditor Dave Yost, the Ohio Society of CPAs, the Mid-Ohio Regional Planning Commission, the Federal Reserve Bank, the Ohio Municipal League, and various local government officials. On April 20th, GOPC submitted written testimony as an interested party for HB 130 and the bill was subsequently passed by the Committee. The next step for this bill in the legislation process is for the bill to be referred to the Speaker’s office, where he will decide when or if the bill will receive a vote on by the House.

HB 134 UPDATE: Activity for HB 134 has been picking up since its referral to the Senate Government Oversight and Reform Committee in early December. The bill, which proposes to establish summary actions to foreclose mortgages on vacant and abandoned residential properties received its first hearing April 13th. Co-sponsors of the bill, Representatives Cheryl Grossman (R-Grove City) and Mike Curtin (D-Marble Cliff) offered testimony on behalf of the bill. Various members of the Committee voiced their concerns for property owners within the legislation. Final comments by the Committee members and co-sponsors included continuing an open dialogue to address better protection for property owners with regards to the inspection process contained within the bill. So far HB 134 has received one hearing in the Senate; however, we anticipate the bill may be able to gain more traction with the continuing efforts to improve the legislation.

HB 134 UPDATE: Activity for HB 134 has been picking up since its referral to the Senate Government Oversight and Reform Committee in early December. The bill, which proposes to establish summary actions to foreclose mortgages on vacant and abandoned residential properties received its first hearing April 13th. Co-sponsors of the bill, Representatives Cheryl Grossman (R-Grove City) and Mike Curtin (D-Marble Cliff) offered testimony on behalf of the bill. Various members of the Committee voiced their concerns for property owners within the legislation. Final comments by the Committee members and co-sponsors included continuing an open dialogue to address better protection for property owners with regards to the inspection process contained within the bill. So far HB 134 has received one hearing in the Senate; however, we anticipate the bill may be able to gain more traction with the continuing efforts to improve the legislation.

HB 182 UPDATE: HB 182 continues to move smoothly through the legislative process. HB 182 proposes to allow local governments to establish Joint Economic Development Districts (JEDDS) for development purposes. On April 27th, the bill received its first hearing within the Senate Ways and Means Committee. The bill sponsor, Representative Kirk Schuring (R-Canton), offered sponsor testimony and reported to the Committee that he is working with various stakeholders with the hopes of coming up with a final version that everyone can agree on in the near future.

HB 182 UPDATE: HB 182 continues to move smoothly through the legislative process. HB 182 proposes to allow local governments to establish Joint Economic Development Districts (JEDDS) for development purposes. On April 27th, the bill received its first hearing within the Senate Ways and Means Committee. The bill sponsor, Representative Kirk Schuring (R-Canton), offered sponsor testimony and reported to the Committee that he is working with various stakeholders with the hopes of coming up with a final version that everyone can agree on in the near future.

HB 233 UPDATE: HB 233, which proposes to authorize municipal corporations to create downtown redevelopment districts (DRDs) and innovation districts for the purposes of promoting the rehabilitation of historic buildings and encourage economic development, had several witnesses attend committee to offer support. Proponents of HB 233 included The Cincinnati Museum Center and the Ohio Environmental Council. Members of the Committee accepted two amendments without objection. One, from Chairman Peterson, would extend the charitable use tax exemption to children's, science, history, and natural history museums open to the general public, and the second, from Sen. Eklund, which provided clarifying language for bonding purposes. HB 233 was voted out of the Senate on April 13th, and the House unanimously granted final approval of the bill on April 20th. The final step in the legislative process for HB 233 is for the Governor to sign the bill into law. (HB 233 was signed into law by Governor Kasich May, 6 2016.)

HB 233 UPDATE: HB 233, which proposes to authorize municipal corporations to create downtown redevelopment districts (DRDs) and innovation districts for the purposes of promoting the rehabilitation of historic buildings and encourage economic development, had several witnesses attend committee to offer support. Proponents of HB 233 included The Cincinnati Museum Center and the Ohio Environmental Council. Members of the Committee accepted two amendments without objection. One, from Chairman Peterson, would extend the charitable use tax exemption to children's, science, history, and natural history museums open to the general public, and the second, from Sen. Eklund, which provided clarifying language for bonding purposes. HB 233 was voted out of the Senate on April 13th, and the House unanimously granted final approval of the bill on April 20th. The final step in the legislative process for HB 233 is for the Governor to sign the bill into law. (HB 233 was signed into law by Governor Kasich May, 6 2016.)

HB 303 UPDATE: Throughout April HB 303—the DOLLAR Deed Program-- received three hearings within the Senate Financial Institutions Committee, and is expected to have a fourth hearing in early May. Due to this increased activity, GOPC has moved this bill from the yellow column to the green, which indicates faster movement and increased likelihood of passage. The bill sponsor, Representative Jonathan Dever (R- Cincinnati), offered testimony that explained what the bill proposed and added that Ohio would be "on the cutting edge" since no other states have yet implemented anything like it. The second hearing was designated for proponents to present their perspectives and included the Ohio Real Estate Investors Association, the Ohio Housing Finance Agency, and the Ohio Credit Union League. The third hearing was held on April 26th, which provided opposing parties to bring forward their concerns with the bill; however, there were none. GOPC anticipates HB 303 will receive a fourth hearing by mid-May where GOPC and other stakeholders will be given the opportunity to offer Interested Party testimony.

HB 303 UPDATE: Throughout April HB 303—the DOLLAR Deed Program-- received three hearings within the Senate Financial Institutions Committee, and is expected to have a fourth hearing in early May. Due to this increased activity, GOPC has moved this bill from the yellow column to the green, which indicates faster movement and increased likelihood of passage. The bill sponsor, Representative Jonathan Dever (R- Cincinnati), offered testimony that explained what the bill proposed and added that Ohio would be "on the cutting edge" since no other states have yet implemented anything like it. The second hearing was designated for proponents to present their perspectives and included the Ohio Real Estate Investors Association, the Ohio Housing Finance Agency, and the Ohio Credit Union League. The third hearing was held on April 26th, which provided opposing parties to bring forward their concerns with the bill; however, there were none. GOPC anticipates HB 303 will receive a fourth hearing by mid-May where GOPC and other stakeholders will be given the opportunity to offer Interested Party testimony.

HB 418 UPDATE: Last month, HB 418 received two hearings within the House Financial Institutions, Housing and Urban Development Committee. Representative John Barnes (D- Cleveland) offered sponsor testimony and explained that his bill would help protect senior citizens, who have lived in their homes for at least 20 years, from seizure of their property if they have delinquent property taxes. One member of the Committee stated he was concerned about the potential abuse of this new policy and mentioned that safeguards should be put in place to remedy the flaw. The following week, Representative Barnes offered an amendment to HB 418, which would prohibit tax foreclosures on senior-owned homesteads if delinquent taxes, assessments, charges, penalties and interest on the property do not exceed $5,000. The amendment also requires dismissal of foreclosure proceedings against a senior-owned homestead (presumably with a tax debt greater than $5,000) if the tax bill on the homestead increased for two or more years, during which the delinquency occurred, and the property owner's financial circumstances likely contributed to the their inability to pay the taxes due. The committee approved of the amendments to HB 418 and the sponsor is continuing to work with members to produce a bill that everyone can agree upon.

HB 418 UPDATE: Last month, HB 418 received two hearings within the House Financial Institutions, Housing and Urban Development Committee. Representative John Barnes (D- Cleveland) offered sponsor testimony and explained that his bill would help protect senior citizens, who have lived in their homes for at least 20 years, from seizure of their property if they have delinquent property taxes. One member of the Committee stated he was concerned about the potential abuse of this new policy and mentioned that safeguards should be put in place to remedy the flaw. The following week, Representative Barnes offered an amendment to HB 418, which would prohibit tax foreclosures on senior-owned homesteads if delinquent taxes, assessments, charges, penalties and interest on the property do not exceed $5,000. The amendment also requires dismissal of foreclosure proceedings against a senior-owned homestead (presumably with a tax debt greater than $5,000) if the tax bill on the homestead increased for two or more years, during which the delinquency occurred, and the property owner's financial circumstances likely contributed to the their inability to pay the taxes due. The committee approved of the amendments to HB 418 and the sponsor is continuing to work with members to produce a bill that everyone can agree upon.

HB 463 UPDATE: HB 463 received a total of four hearings throughout the month of April within the House Financial Institutions, Housing and Urban Development Committee, and was ultimately reported out of Committee on April 27th. During this period various stakeholders came together to cite their support for the bill including Professor Jeff Ferriell of Capital University Law School, the Ohio Bankers League, the Ohio Mortgage Bankers Association, and attorney Tony Fiore of Kegler Brown Hill + Ritter. HB 463 received a third hearing, which provided Interested Party members the opportunity to testify. Among the three interested parties were the Ohio Judicial Conference, the City of South Euclid and Greater Ohio Policy Center. Greater Ohio’s testimony offered commentary about the positive aspects of the legislation, but also brought forward concerns regarding the Ohio Uniform Commercial Code changes involving mortgages and notes that have been lost. Witnesses that offered proponent testimony on behalf of HB 463 included former Attorney General Marc Dann, the City of Cincinnati, the Ohio Recorders Association, the Franklin County Treasurer’s Office, and the Ohio Manufactured Homes Association.

HB 463 UPDATE: HB 463 received a total of four hearings throughout the month of April within the House Financial Institutions, Housing and Urban Development Committee, and was ultimately reported out of Committee on April 27th. During this period various stakeholders came together to cite their support for the bill including Professor Jeff Ferriell of Capital University Law School, the Ohio Bankers League, the Ohio Mortgage Bankers Association, and attorney Tony Fiore of Kegler Brown Hill + Ritter. HB 463 received a third hearing, which provided Interested Party members the opportunity to testify. Among the three interested parties were the Ohio Judicial Conference, the City of South Euclid and Greater Ohio Policy Center. Greater Ohio’s testimony offered commentary about the positive aspects of the legislation, but also brought forward concerns regarding the Ohio Uniform Commercial Code changes involving mortgages and notes that have been lost. Witnesses that offered proponent testimony on behalf of HB 463 included former Attorney General Marc Dann, the City of Cincinnati, the Ohio Recorders Association, the Franklin County Treasurer’s Office, and the Ohio Manufactured Homes Association.

Now that the bill has been voted affirmatively out of Committee, GOPC anticipates HB 463 will make its final steps out of the House by the end of May.

New Bills & Explanation of Bill Impact on Economic Development within Ohio:

HB 512 is sponsored by State Representative Tim Ginter (R-Salem). This bill proposes to establish requirements governing lead and copper testing for community and non-transient non-community water systems, to make appropriations to the Facilities Construction Commission for purposes of providing grants for lead fixture replacement in eligible schools, and revise the laws governing the Water Pollution Control Loan and Drinking Water Assistance Funds. Greater Ohio has been leading the charge on studying Ohio’s Water/Sewer infrastructure needs, and although HB 512 isn’t directly related to Ohio’s gray infrastructure needs, the bill is still of interest as water contamination and water infrastructure are interrelated. GOPC will continue to monitor HB 512 as it moves through the legislative process.

HB 512 is sponsored by State Representative Tim Ginter (R-Salem). This bill proposes to establish requirements governing lead and copper testing for community and non-transient non-community water systems, to make appropriations to the Facilities Construction Commission for purposes of providing grants for lead fixture replacement in eligible schools, and revise the laws governing the Water Pollution Control Loan and Drinking Water Assistance Funds. Greater Ohio has been leading the charge on studying Ohio’s Water/Sewer infrastructure needs, and although HB 512 isn’t directly related to Ohio’s gray infrastructure needs, the bill is still of interest as water contamination and water infrastructure are interrelated. GOPC will continue to monitor HB 512 as it moves through the legislative process.

For more details and information on legislation that GOPC is tracking, please visit our Previous Legislative Updates.