The book includes guidance for local governments on implementing a pre-approved plans program, an initiative which can reduce permitting timelines and costs associated with development.

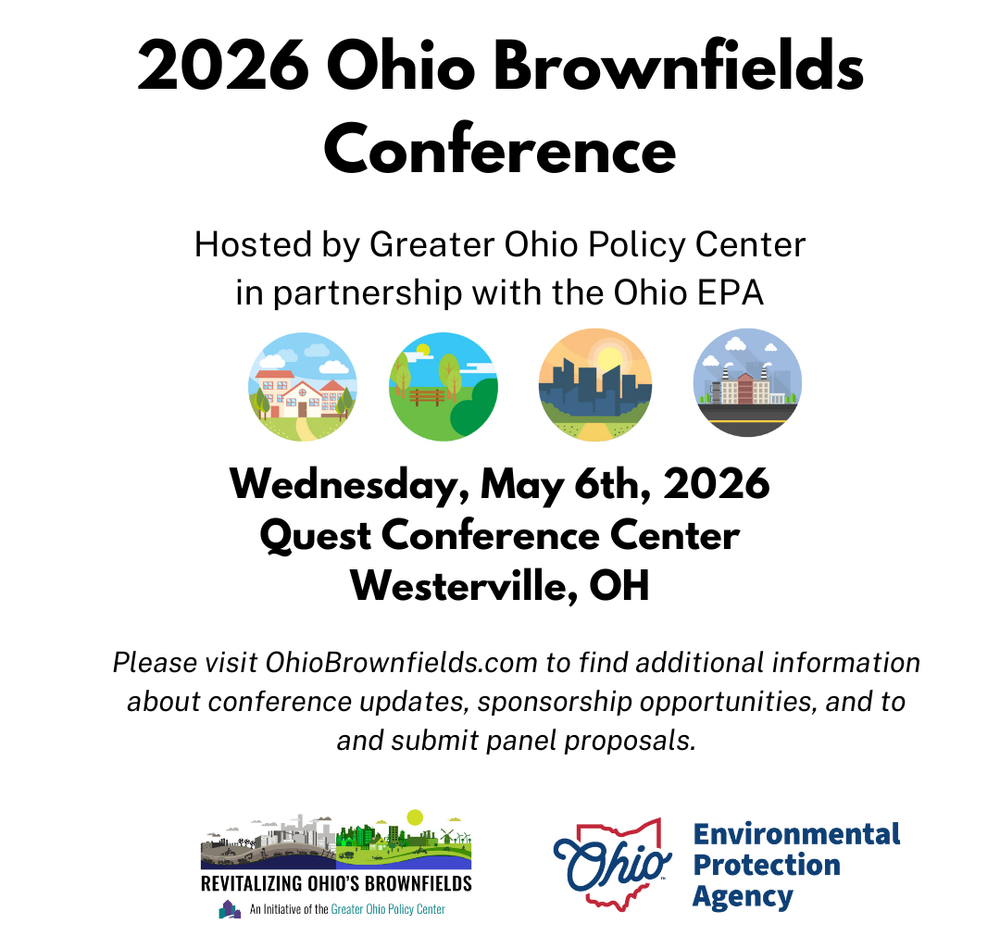

Registration is now open for the 2026 Ohio Brownfield Conference

Celebrate 250 Years of Independence in 2026!

The America 250-Ohio Commission has been planning a series of events throughout 2026 to celebrate the nation’s birthday in true “Ohio Style”.