This conference will focus on bike and pedestrian infrastructure, funding and financing for complete streets infrastructure improvements, successful strategies for educating the public, and more.

New Map Shows Growth of Housing Preapprovals in Ohio

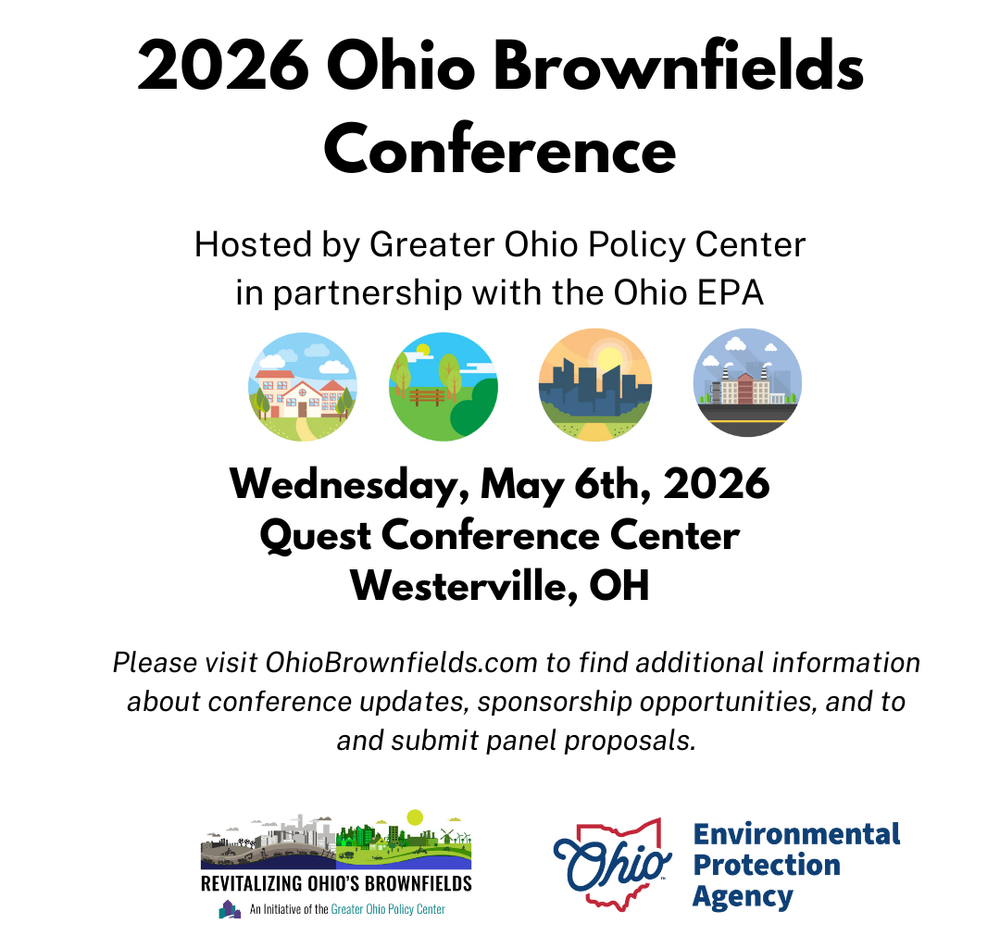

Registration is now open for the 2026 Ohio Brownfield Conference

Celebrate 250 Years of Independence in 2026!

The America 250-Ohio Commission has been planning a series of events throughout 2026 to celebrate the nation’s birthday in true “Ohio Style”.